We hope you love the products we recommend! Just so you know, Trendy Mami may collect a share of sales or other compensations from the links on this page.

–

While children are often bundles of joy, childcare expenses are a drain on most families’ financial resources. From keeping a roof over their heads to affording educational expenses and putting food on the table, parents spend upwards of $11,990 per child annually, even in lower-income families. The IRS Child Tax Credit provides the Child Tax Credit to offer families some relief from child-related expenses.

But what is the Child Tax Credit, and how do you file for it? Learn more here, along with how H&R Block can help you claim it on your tax returns.

Help with Claiming the Child Tax Credit

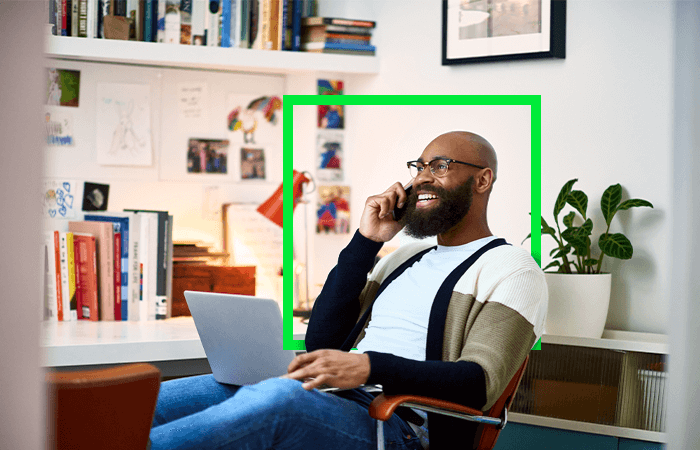

If you want help with any part of filing your taxes, H&R Block provides tools and services that will guide you through the process.

With H&R Block, you can choose between filing by yourself online with live, expert help whenever you need it or working with a tax pro, who will file your taxes for you. When you use either of these options, you’ll receive guidance every step of the way, making it easier to file your taxes and claim the right credits, including the Child Tax Credit if you’re eligible.

And now until April 15th, you can get 15% off H&R Block’s online filing tool with access to free expert help!

What Is the Child Tax Credit?

Put simply, the Child Tax Credit allows families with eligible children to receive a break on their taxes. For 2024 tax filings, eligible children are:

- Under the age of 17 at the end of the year

- Be your own child, stepchild, sibling (including step-siblings or half-siblings), foster child, or a descendant of a person in those categories

- People who have not contributed to more than half of their own care in 2024

- People who have lived with you for more than half of the tax year

- Claimed as a dependent on your tax return

- Those who have lived in the U.S. as a citizen, national, or legal resident

- Those who possess a valid Social Security Number

- Individuals who have not filed a joint return (or have filed one only to claim estimated taxes or a refund of taxes)

In addition, if you are a single filer, your income must not exceed $200,000 if you wish to claim the full benefit amount. For married couples filing jointly, the maximum income to claim the full Child Tax Credit is $400,000.

People with incomes that exceed these threshholds may be eligible for a partial credit.

For each qualifying child, those who receive the full Child Tax Credit will receive $2,000. For 2024, $1,700 of this credit is refundable.

How to Claim the Child Tax Credit

You claim the Child Tax Credit whenever you fill out Form 1040, which is the mandatory, individual income tax document used by people who earned income in the United States. In addition, you’ll need to complete and attach Schedule 8812, which determines whether you qualify for the Child Tax Credit.

Here are some additional documents you may want to have on hand when filing for the Child Tax Credit:

- Proof of where you lived during 2024 and proof of where the child(ren) in your care lived (such as school records, etc.)

- For non-custodial parents of a child whose parents are divorced, separated, or living living apart: a copy of the custodial agreement, divorce decree, or separation agreement, along with a completed Form 8332 (Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent).

- If the child(ren) in question belong to more than one taxpayer, collect documentation that proves the child lived with you or their other parent/guardian for the majority of the year. You’ll also want to provide the name of the other parent/guardian and, if possible, their Social Security Number.

- The child’s birth certificate or their adoption certificate (if applicable). Guardians of foster children should submit their proof of placement.

If the child was born outside of the United States, here are some additional documents to send to the IRS:

- A copy of the child’s Social Security Number card.

- Records proving the child was living in the United States during the applicable tax year. These can include school records, health insurance, and legal or financial documents.

As always, H&R Block can help you claim the Child Tax Credit if you’re eligible. Whether you choose to do your taxes yourself online or file with a tax pro, H&R Block’s products will guide you through claiming the credit.

Getting the Most Out of Your Tax Credits

The Child Tax Credit provides you with some assistance with the cost of raising and supporting children. While we can’t guarantee you’ll qualify for the Child Tax Credit or a tax return, having some experts on hand can provide you with excellent tax guidance.

Want to be more prepared for tax season? Here are some tips!